Authorised Capital

What is Authorised Capital?

Authorized capital, also referred to as Authorised share capital, registered capital, or nominal capital is the maximum amount of capital that a company can raise as stated in its memorandum of association.

In some countries, authorised capital is also defined as the maximum number of stocks or shares that a company is authorised by its charter documents to issue to its shareholders.

How is authorised capital calculated?

Authorised Capital = Issued Capital + Unissued Capital

Authorised Capital with example:

If a company has authorised capital of Rs. 1,00,00,000 (Rs 1 Crore) made up of 10 lakh shares with a face value of Rs. 10 each, then the maximum amount of capital a company can raise by issuing shares to its shareholders is Rs 1 crore.

In the future, if the company only raises authorised capital worth Rs 20 lakhs, then Rs 80 lakhs worth of authorised capital can be used for future issuance of shares.

What is the Memorandum of Association (MoA)?

During the incorporation, the company has to file a legal document with the Registrar of Companies (RoC). This legal document is referred to as Memorandum of Association. It comprises of:

- Name clause

- Authorised capital clause

- Registered office clause

- Objective clause

- Liability clause

- Association clause

What is an Article of Association (AoA)?

The rules and regulations concerning the management of a company are stated in the Articles of Association.

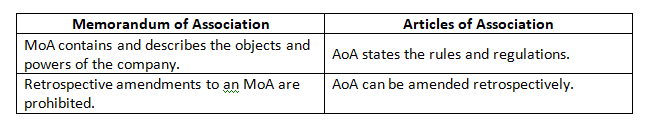

What is the difference between MoA and AoA?

What is Paid-Up Capital?

Paid-Up capital definition: Paid-up capital is defined as the amount of money or capital that the company receives in exchange of the shares issued to shareholders.

In simple words, it is the money invested by shareholders into a company in exchange for shares.

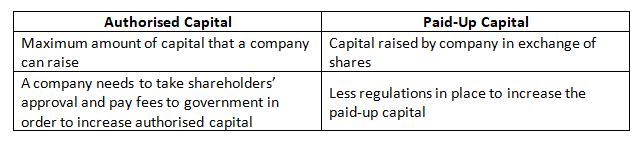

Difference between Authorised capital and Paid-Up capital?

What is Issued Capital?

Issued share capital is the value of shares the company issues out of the authorised capital. Authorised capital is generally higher than issued capital as the company gets an opportunity to issue additional shares in the future if its issued share capital is less than authorised capital.

What is Subscribed Capital?

Subscribed shares are those shares that the investors have promised to buy in the future. Subscribed capital is the value of shares for which investors have expressed an interest to buy.

What is Called-up Capital?

Called-up capital is that partial amount of money out of the issued share capital that investors are required to pay. In some countries, countries are permitted to ask for a partial amount of share value instead of full value.

Example:

Champion Sports Ltd was registered with an authorised capital of Rs. 1,00,00,000 with a face value Rs. 10.

Applications were received for 1,00,000 shares but the company actually issued 80,000 shares where the company has called for Rs. 9 per share.

All the calls have been met in full except two shareholders who still owe for their 5000 shares in total.

Solution:

Authorised capital = Rs. 1,00,00,000

Subscribed capital = 1,00,000 x 10 = Rs. 10,00,000

Issued Capital = 80,000 x 10 = Rs. Rs. 8,00,000

Called-Up Capital = 80,000 x 9 = Rs. 7,20,000

Paid-Up Capital = Rs. 7,20,000 – (5000 x 9) = Rs. 6,75,000