Retail investors and financial influencers on Twitter mocked Mercedes-Benz India’s top executive’s comments that the luxury car business is getting affected as more potential Indian customers are opting for a monthly SIP. Santosh Iyer, Mercedes-Benz India’s sales and marketing head, told in an interview that, unlike the West, India has a strong savings mindset owing to weaker social security measures and they save not just for themselves but also for their kids”, he said.

A systematic investment plan (SIP) helps people invest a specific amount of money in the markets every month to gain from compounding over the long term.

Why only SIPs?

Mr. Iyer’s comments came under heavy flak. Comments like “tone-deaf”, “unaware of the Indian market”, and “laughable excuse for sale target shortfall” circulated on social media. One fund manager tweeted that Mercedes want to trade off their and their kids’ future for a luxury car. “Ironically, if one starts SIP early, one can even purchase a Mercedes,” another tweet read. First of all, ₹50,000 EMI is not sufficient to pay for the cheapest Mercedes car. Secondly, out of all the things that Indians could spend on instead of paying EMIs for luxury cars, why did Mr. Iyer pick only mutual fund SIPs? Why not, home loan EMIs? After all, we need a home to park the Mercedes right? And, with home loan EMIs, one ends up owning an asset that appreciates in value over time and would make a more fitting competitor.

Unusual competitors

Well, Mr. Iyer is not the only one to have an unusual idea of whom it’s competing with. Source: BHP

Source: BHP

His comments reminded me of Netflix’s Reed Hastings statement back in a 2017 earnings call when he claimed that Netflix’s competition is not with rival streaming channels, but with sleep! He said that he isn’t really concerned about Amazon and HBO because the market is just so vast.

But, rather than competing against sleep shouldn’t they have ideally focussed on the power of a good night’s sleep or promoted a free sleep channel to help people sleep better post-binge-watching at odd hours? That would have been a real differentiator and a great idea for a marketing campaign.

It is strange that companies first target human greed for consumption, and later complain about innate human behaviour and basic building habits. It is these SIPs that practically saved Indian markets from the global rout. The Merc leader should instead be happy as these SIPs can empower average Indian retail investors to splurge on discretionary premium products in future.

Customer is king, always!

The competition that Netflix had grossly underestimated came haunting back to the company this year. After enjoying two golden years of skyrocketing streaming viewership thanks to the pandemic, Netflix lost significant subscribers early this year to competition.

In a nutshell, do not take your consumers for granted. In today’s marketplace, nothing is holier-than-thou.

So, if it’s not the SIPs, then what is really ailing the Indian luxury car market?

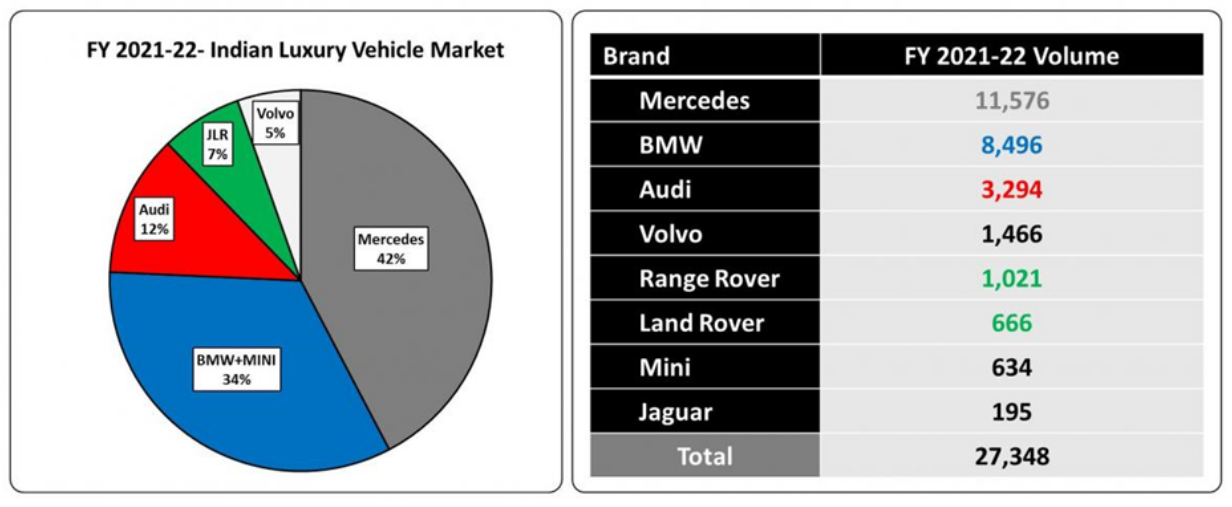

As per The Knight Frank “India Wealth Report 2021”, India has 113 billionaires and 6,884 UHNIs (Ultra High Net-worth Individuals), 250,000 millionaires, and an even larger number of HNIs who earn roughly ₹40 Lakh every year. In short, there are enough people in India who can afford a vehicle costing INR 40-50 lakh and above at least once in their lifetime. Yet, Indian luxury vehicle sales account for about 1.2% of the overall automobile market in India, compared to 13% in China and 10% in the US.

Product market misfit

It has basically become a chicken and egg situation where each brand is waiting for the others to expand the market size. While there have been several instances of tailor-made vehicles for the Chinese market there have been none for the Indian one.

The cost of ownership of a luxury brand is very high but service standards are not at par and in some cases, fall below that of the mainstream brands like Maruti Suzuki and Hyundai. Most loyalty programs are purely sales-focused, selling a new accessory or a new product in exchange for the existing one. There is very little effort by the brands to connect with their customers once the sale is over. This is evident from the repeated brand switches by customers every 3-5 years based on popularity. Even on the product side, there have been instances where features and quality have been compromised to keep prices down. Both Audi A3 and first-generation Mercedes-Benz GLA failed as they were complete misfits for the Indian riders.

While no one denies the high taxation structure in India but that cannot be taken as an excuse for poor product market fit and service standards.

Be human, not Godly!

A Mercedes-Benz C300 will surely give you an adrenaline rush but a huge loan to pay off this depreciating asset is going to take that away very soon! Maybe, Mercedes, instead of targeting this saving mindset, you need to come down from your high pedestal and make yourself more relevant to the rich Indians.

Disclaimer: This write-up is solely for educational purposes. This in no way should be construed as a buy/sell recommendation. Please consult your investment advisor before investing.

Tavaga is everything you need to start saving for your goals, stay on track, and achieve them in time

Download Now: